The Rise of Private Equity Secondaries

Explore the evolution of secondary markets, their structure, key trends, and why they're now essential in private wealth portfolios.

As the global venture capital (VC) and private equity (PE) industry continues to grow and change, the secondary market has become an indispensable focal point for many investors. This market is situated in a position of slowing activity in public offerings, increasing interest rates, and changing investor concerns and risks. The secondary market is the only path to present and future funding since company IPOs are prolonged or skipped, and traditional exit strategies are ineffective.

This post will explore what makes private equity secondaries important now, why venture capital faces difficulties while facing inflation, and why more institutional investors are paying attention to it. At Wealt, we have an adequate appreciation of these trends, not to mention the chances they availed. Our mission is to lead our members through the multi-faceted secondary market to best take advantage of hidden investments that were previously unavailable.

What are private equity secondaries?

Secondaries consist of selling an investor's pre-existing positions in an underlying asset or a company. Contrary to primary investments, which mean that **funds are provided directly to a company or an investment in a venture, secondaries **imply that new persons come in to replace the old ones. This market is very important in providing a market for those who require liquidity and wish to sell their stakes in private companies/funds.

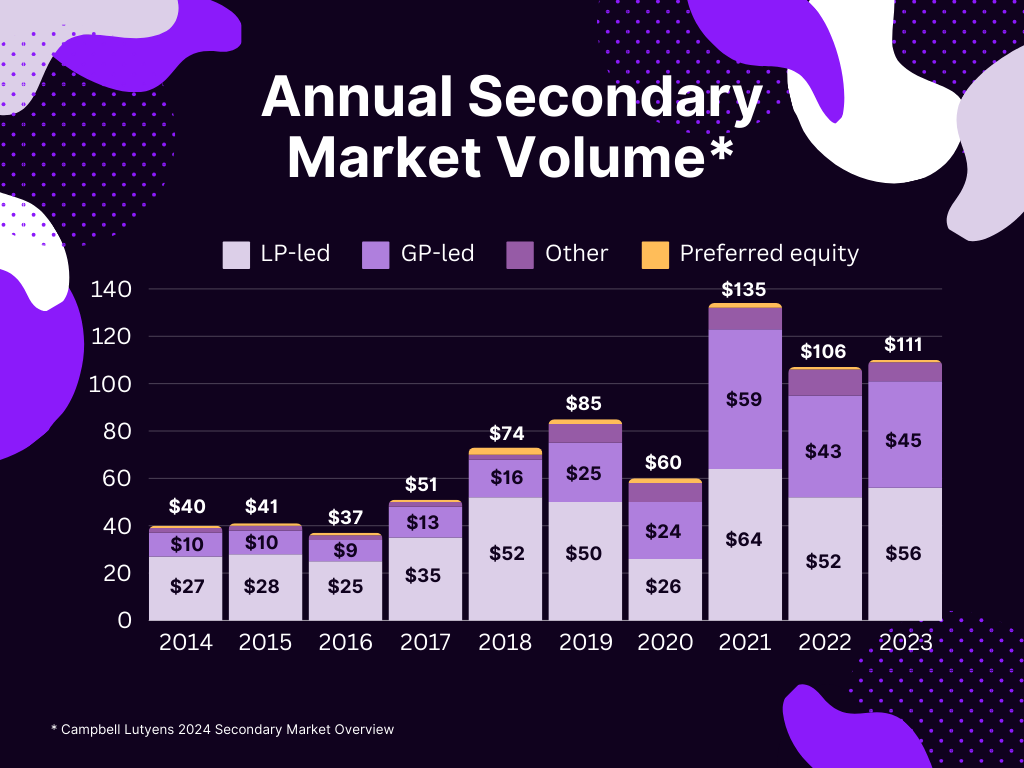

The private equity secondary market was created by Dayton Carr, the founder of VCFA Group, in 1982. It had its first commitment as a fund in 1984, which was $6 million. Since then, the amount and popularity have evolved. Deals on the secondary market reached a record level of transactions of $114 billion, which testifies to the growing role of this segment. This increased activity underlines how secondaries have a significant function in meeting the peer-to-peer secondary market and reallocating capital across the PE industry.

Private equity types: GP-led & LP-led

There are two main types of private equity secondaries: GP-led and LP-led.

GP-led secondaries occur when the existing general partner or the fund manager sells part or the entire fund to a secondary investor; LP-led secondaries, on the other hand, occur when an individual or institutional investor who wishes to divest themselves of their stake in a private equity fund on the secondary market sells out to another investor.

The main difference is that GP-led deals are driven by the fund manager to increase the fund’s lifespan with new investors, while LP-led deals are transactions undertaken by existing investors to liquidate themselves from the fund for various reasons.

Struggle of exits in VC under inflationary backdrop

KPMG has recently noted that many venture capital funds are challenged in their exit strategy as inflation and rising interest rates affect valuations and investor confidence. It has become even trickier for VCs to realize the exits that could be useful in returning the capital to the limited partners(LPs), worsening the funding cycle. So, there is less available dry powder for follow-on investment rounds.

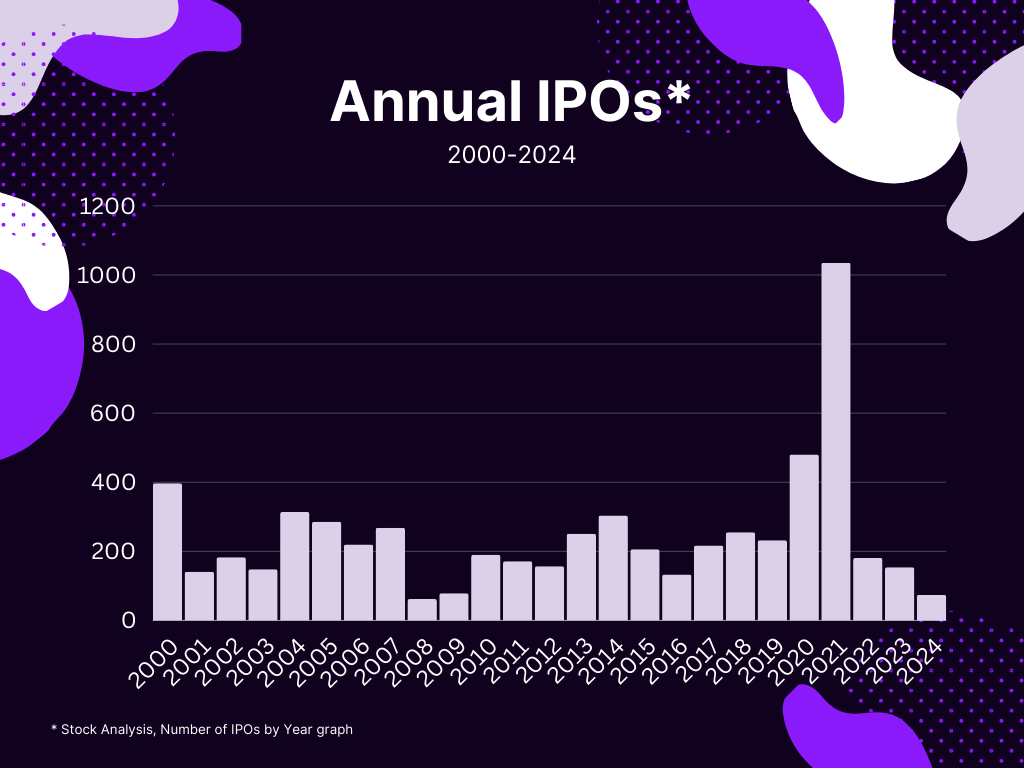

In the post-COVID world, there was an increase in valuations catalysed by the primary fundraising attempts, which concentrated more on growth while sacrificing sustainability. However, the existing economic backdrop and availability of cheap funding have changed enormously. During 2022-2024, Managers of venture capital funds have become hesitant to sell their assets under down-round valuation cycles. On the other hand, startup founders suffered from a significant slowdown in the interest of initial public offerings(IPOs), mainly due to macroeconomic headwinds and profitability concerns. This hesitation has disrupted the funding cycle—fundraising has become trickier, and the costs of such a process have increased.

Why did secondaries become so important?

Secondary markets have become significantly more relevant in recent years due to several factors originating from the challenging economic climate and overall hurdles regarding fundraising. VCs and PE funds are now under pressure, and secondary markets have become an important way to solve challenges associated with liquidity concerns, the closed IPO environment, and the problem of retaining founders and employees.

Liquidity needs in the industry.

The venture capital and private equity industry's liquidity requirements have changed. First movers in early-stage VCs are struggling to access late-stage investments due to the slowed escalation of fundraising. This has inevitably led to the need for efficient liquidity management instruments, such as secondary markets, to help VCs better control their portfolios.

IPO interest is down.

There is less interest in initial public offerings (IPOs) as more firms have been priced down, and future growth rates have come down as 2023 has become the dry year for the IPO landscape. Lower valuations, decelerating growth rates and intensifying focus on profitability over pure top-line growth have severely dampened appetite for new public listings. Cost-cutting pressures make extended private company runways difficult. This has made secondary markets the new exit channel for investors seeking to exit the venture from their funds.

Long-term vesting of employees and founders enigmatic.

Another compound factor is the long-term vesting periods proposed for employees and the founders. Retaining top talent becomes challenging when lucrative liquidity events get pushed further and further into the future. When these stakeholders want to unlock this liquidity, secondary markets present a near-perfect solution because they enable these investors to sell their equity stakes and realize the value without waiting for their company to go public or be sold.

What is happening in the secondary market, and why is institutional money investing?

As the market for secondaries has become more significant, much of the focus has shifted, and the attention of institutional investors has been targeted. As global businesses’ liquidity requirements increase and initial exit opportunities remain limited, venture capital and private equity venturers have used the secondary market as an exit strategy. This has led to an explosive rate of growth and development of the secondary landscape in particular.

- The overall secondary market has a total of $111 billion in 2023 and total available dollars for deals as of Q1 2024 to $174 billion.

- Today’s environment offers a favourable value creation opportunity since market liquidity remains low, giving incoming investors excellent opportunities to purchase high-quality assets at discounted prices.

- A spurt in the formation of secondary funds signifies the increasing attraction of potential players towards this segment and the realization of opportunities in the secondary market.

- Secondary transactions serve as bridge finance to help firms manage their capital requirements in the time gap between one funding round and the other or in a period that is detrimental to fund-raising.

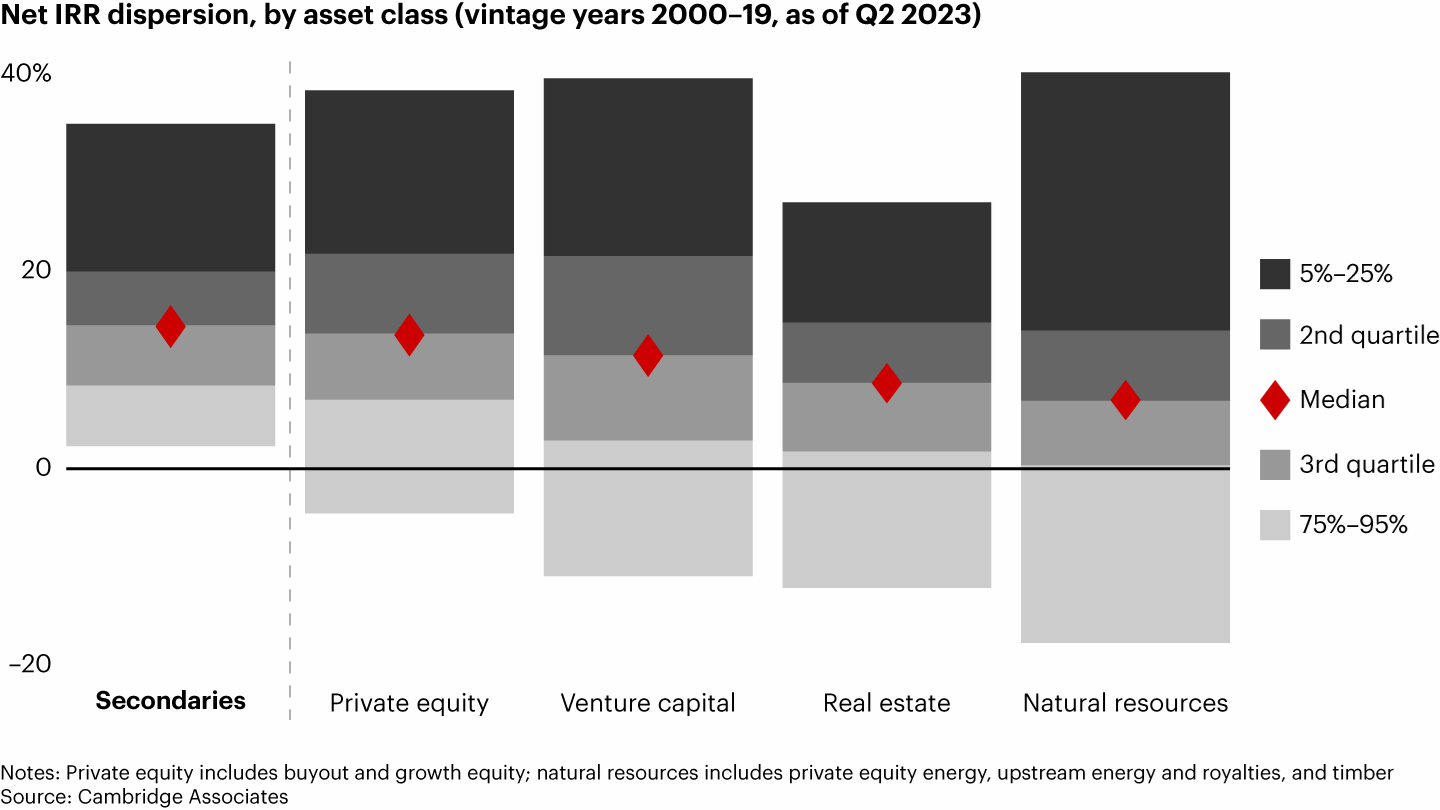

- The secondary market has more potential than public markets because it is practical for investors to buy certain assets at much lower prices than their worth and, when they exit, get a much higher return. Even in the alternative investments universe, secondaries have performed better as a strategy than most, with higher IRR median and low dispersion, delivering better risk-adjusted returns and making excellent portfolio diversification for HNWIs and sophisticated investors.

Wealt Club: Secondary market opportunities

We are presenting our highly-anticipated exclusive club — The Wealt Club! Our vision of an alternative market for sophisticated investors. This is why Wealt Club will allow our members to receive information about such opportunities every minute and second. Private equity investments have consistently produced some of the strongest rates of return over the last years, and the secondary market is no different. Instant access to connected with private equity, VC, real estate and exclusive pre-IPO deals, amazing things waiting for you with low required investment minimums. This means that what once was a preserve of a few people is now open to different people through different investment avenues.

Investing in Wealt Club offers customers great investment opportunities and opens the door to a rich private life. The loyalty program privileges unusual VIP treatment, special access and favours, and unique invitations and experiences meant to enhance clients’ lives. Furthermore, it builds a sense of unity for individuals motivated to strive for success, enabling members to interact directly with peers and influential business personalities, professionals, and visionary entrepreneurs. Through the intelligence of an experienced members’ investors fund, the communities learn new ideas, strategies, and points of view that may help them make better and more informed choices about their investments and themselves financially. Welcome to the Wealt Club, where you can become a part of the elite circle of wealthy individuals, achieve more financially, and receive access to the best offers and events.

Subsribe to our weekly newsletter

Get our Sunday morning newsletter with exclusive deals, portfolio updates, and private market insights delivered straight to your inbox.