5 Steps To Control Your Financial Destiny As A Woman

Financial independence, defined as the ability to support oneself financially without assistance, is particularly important to women historically marginalised in the labour market.

Financial awareness and savvy money management skills give women a sense of security, enabling them to save, invest and manage life's uncertainties effectively. More than financial security, achieving independence empowers women to make life choices, secure the future of their loved ones and build confidence in their financial decision-making.

A closer look at the state of women's finances

The UBS Global Wealth Management Investor Watch report of 2019 surveyed female investors worldwide to explore their approach to financial well-being. The report found that the traditional financial approach, in which women manage day-to-day expenses while men take care of long-term planning, leaves women ill-prepared for major life events such as divorce or the death of a partner.

Key findings include that women are aware of their long-term financial needs (e.g. retirement planning, long-term care and insurance), but few make long-term financial planning decisions (only 23%). Instead, women control day-to-day spending (85%) and often leave important financial decisions to their spouses (58%). This behaviour can put women at financial risk at crucial moments. The study advocates couples working together on long-term financial planning, citing benefits such as increased confidence, fewer mistakes and reduced financial stress for women who do so.

Numerous studies have consistently shown that women outperform men when it comes to investing, with the only question being the extent of their outperformance. In a 2021 analysis of 5 million Fidelity clients over a decade, women outperformed men by 0.4.

So why do women face challenges?

Women face many obstacles, including the gender pay gap, an unspoken glass ceiling, juggling multiple responsibilities and limited financial literacy. Forward-thinking, values-driven financial institutions actively address these issues by implementing initiatives to transform the financial industry, advancing gender equality and promoting women's inclusion.

- In the UK, as around the world, the gender pay gap is a major issue. According to data from the London Stock Exchange, closing this gender gap can unlock more than £140 billion in economic value in the UK alone. Such benefits would be transformative for businesses across various sectors beyond the confines of the financial services industry. If we look at the average hourly pay gap between men and women in the UK since 1997, although this rate has fallen from 27.5% to 14.9%, it does not change the fact that there is still a difference that cannot be ignored.

- The invisible glass ceiling is a reality for all women. Although the number of women in the workforce is increasing (72.1% in the second quarter of 2023), this figure drops to 40.2% when we look at senior management. Although only seven women run FTSE 100 companies, the UK is third in the world for the percentage of women on boards - behind France (43.7%) and Italy (40.7%).

- As mothers, wives and carers, women balance many family tasks. Typically, women have been expected to prioritise family responsibilities, sometimes sacrificing their careers to support their family's ongoing needs. Unfortunately, this often means that important financial aspects, such as saving and planning for retirement, are neglected.

- Lack of financial literacy is a global problem. Only 33% of adults worldwide are considered financially literate. The average score on a test measuring basic financial literacy concepts is 61%. However, this percentage is lower for women. In a study by Shepherds Friendly, 31% of men passed the test compared to 24% of women, and men (47%) scored higher than women (34%).

Smashing the challenges

Women face some financial challenges - but they are aware of them. First, you must know that it is there to smash the glass ceiling and other challenges. Women recognise their lack of knowledge, which will be their greatest support. Ignoring the problems won't make them disappear, so you need to start your journey to financial independence today.

Step 1: Create a realistic budget

Budgets allow you to live within your financial means while setting aside funds for future financial goals. It is your financial roadmap. Calculate your net monthly income.

- Net income: (Total wages or salary) - (Taxes and employer-provided programs - retirement plans, health insurance, etc.)

If anything changes that could affect your income, review these steps again.

Step 2: Understand your spending habits

Now you know how much money you can spend - just kidding! Once you've identified your income, the next step is understanding where it goes. Tracking and categorising your spending is crucial to identifying areas where savings can be maximised.

Start this process by making a list:

- Fixed expenses: monthly bills, rent, mortgage, utilities, etc.

- Variable expenses: groceries, gas, entertainment, etc.

There are often opportunities to reduce costs in this category. Start with your credit card and bank statements, which will itemise your expenses.

- Track your daily spending with pen and paper, spreadsheets or easy-to-use apps on your phone.

Step 3: Set clear goals and make a plan

Financial goals are the big-picture objectives you set for managing your money. These goals can range from things you want to achieve soon to long-term aspirations. It's like having a roadmap for your finances: it's easier to achieve your goals if you plan them.

- Narrow it down and set specific goals

- Make your goal measurable

- Set yourself a deadline

Now, it is time to compare your actual and desired expenses. In the second step, you listed your fixed and variable expenses. This will give you a clear idea of what you can expect to spend in the coming months.

- You can now divide your expenses between the things you have to have and the things you want to have.

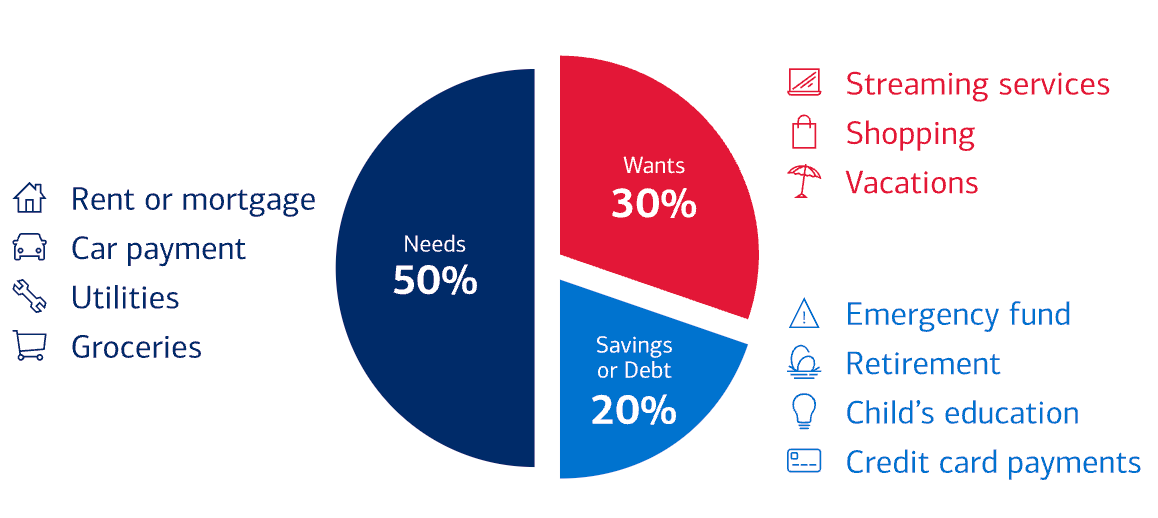

- Use the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings.

Step 4: Improve your financial literacy

These days, it is easy to learn and access different sources. You can find many resources (books, podcasts, blogs, etc.)to help you develop your financial literacy and wealth-building strategies. We have gathered some of them for you to empower yourself.

Books:

- The Little Book of Common Sense Investing - John C. Bogle

- I Will Teach You to Be Rich - Ramit Sethi

- Real Money Answers for Every Woman - Patrice C. Washington

- Financial Feminist - Tori Dunlap

- Girls Just Wanna Have Funds - Female Invest

Podcasts:

- So Money with Farnoosh Torabi - Farnoosh Torabi

- Money Confidential - Real Simple

- Money With Katie Show - Morning Brew

- Financial Feminist - Her First $100K

- The Clever Girls Know Podcast - Clever Girl Finance

Blogs:

Educational resources:

- Your Money Matters - Financial Guide

- Wife.org - Women’s Institute for Financial Education

- Wiser Women - Women’s Institute for a Secure Retirement

- Financial Independence 101 - Choose FI Foundation

Step 5: Invest wisely and plan for retirement

Take the opportunity to invest your money strategically. Women still save more than they invest - with over three million fewer women holding investments than men. In addition, women's average private pension savings are almost £40,000 behind their male counterparts.

- Start investing early and focus on the long-term

- Seek help from an expert financial adviser

Preparation is key to ensuring a secure financial future, particularly in retirement planning. This involves contributing to retirement accounts such as Personal Pensions or ISAs (Individual Savings Accounts) in the UK. Additionally, consider seizing the benefits offered by employer matching programs, which can significantly bolster your retirement savings. It's essential to commence this journey as early as possible, as the sooner you begin, the more robust and secure your retirement nest egg will be.

Preparation is the key to a secure financial future, especially regarding retirement planning. This includes contributing to retirement accounts such as Personal Pensions or ISAs (Individual Savings Accounts) in the UK. You should also consider using employer matching programmes, which can significantly boost your retirement savings. It's important to start this journey as early as possible because the earlier you start, the stronger and more secure your retirement nest egg will be.

Last tips before you go

Do you want to become financially independent, and these five steps are not enough for you? Try adding these tips to the recipe:

- Review and revise your budget at least twice per year

- Add savings to your monthly budget to-do list

- Build up an emergency fund

- Diversify your investments across asset classes

- Check out non-bankable assets

Our blog

Latest blog posts

Tool and strategies modern teams need to help their companies grow.