Childhood Money Lessons and Adult Financial Health

Our journey with money starts early in life. It shapes how we think and act about our finances. From the first coin you dropped into your piggy bank to this day, it all affects your money management. How we manage money and the financial habits we develop, impact the balance and growth of our savings and bank accounts as we progress through adulthood. 🐖 Parental Financial Education During Childhood and Financial Behaviours of Emerging Adults, a paper in the Journal of Financial Counselling and Planning, suggests that financial education from parents is associated with healthy financial behaviours in their adult lives. Similarly, T. Rowe Price's Parents, Kids & Money Survey found that children who regularly talk to their parents about money are more likely to report intelligent money behaviours.

Developing skills and behaviours takes time, and it's crucial to start addressing them from an early age. Money management is no exception to this! As our cognition develops, we start accumulating certain traits and behaviours. Money management involves more than just knowledge or skill; it encompasses behaviours such as budgeting, saving and investing. Being book smart and having a rationale behind your financial decisions can provide comfort, but ensuring the continuity of our finances requires more than that. Successful cases will require consistent actions and behaviours over time.

Today, we’ll explore your money behaviours, how to break the cycle, and the importance of values and perspectives within money.

Childhood experiences and financial attitudes

Our money journey begins in childhood but develops earlier than we realise. The first thing you learn comes from your inner circle, your parents' habits and attitudes, whether they are cautious savers or free-spenders. These actions become our blueprint.

However, these echoes aren’t always positive. Negative experiences and attitudes could lead to unhealthy financial habits. Fear, ignorance, lack of understanding, overspending, extreme frugality, and general anxiety are negative financial habits.

Real-life examples

The commonality of lousy parenting in teaching financial habits may come as a shock to you. Forbes wrote a fantastic article about this, collecting the most common cases and showing the causes and effects of each case. Please remember that these examples are a bit exaggerated.

Your parents were very frugal

- The behaviour: Your parents are denying your desires and expectations as a child. They could be trying to teach you a lesson or putting themselves first financially.

- The influence: Compulsive spending, overspending, can be seen to compensate for your previous experiences and to create a reaction to your inner child's feelings.

Your parents spoiled you

- The behaviour: You grew up with a life of abundance and wanting nothing because you don’t need anything.

- The influence: You used to live a luxurious lifestyle and want to continue that. But the problem is that you may need more income to support yourself without wanting to work.

Your parents never taught you about money

- The behaviour: Money is mainly known for being dirty and taboo. The topic also has gender discrimination - women have a long history of being kept in the dark.

- The influence: You don’t know anything about money. It may come as overspending, under-saving or avoiding financial planning.

Your parents divorced

- The behaviour: This is a reality that many families face and creates all sorts of psychological problems in children, including bad financial knowledge.

- The influence: You are determined to live happily ever after. This can lead you to rush into marriage, buy a house and start a family prematurely or for the wrong reasons.

What are 4 money scripts?

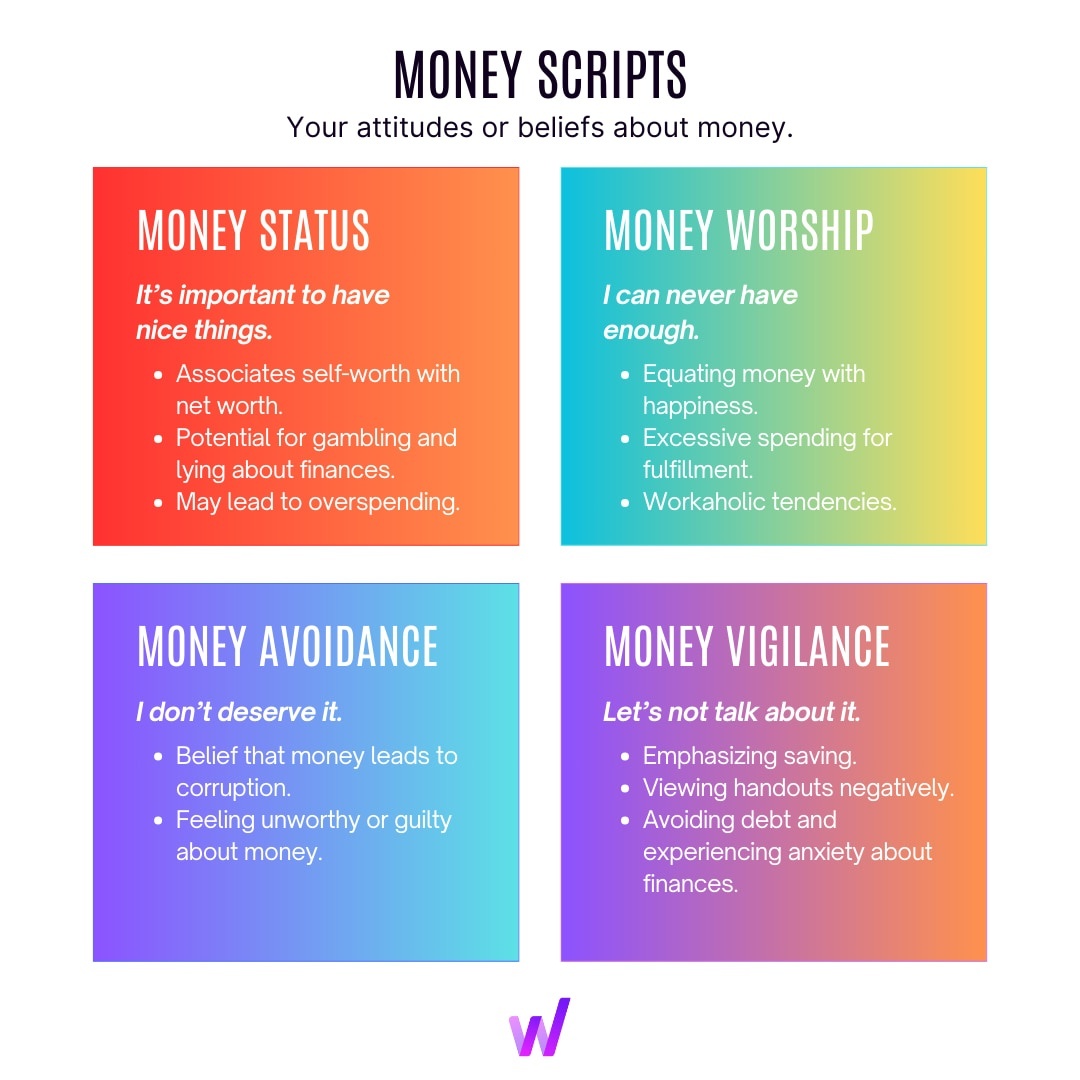

There are 4 money scripts that show your relationship with money: money status, money worship, money avoidance, and money vigilance. These scripts are your attitudes and beliefs rooted in your childhood and impact your current financial life.

The term was created by psychologists Brad Klontz and Ted Klontz in 2011 in Money Beliefs and Financial Behaviours: Development of the Klontz Money Script Inventory.

Money status

“It’s important to have nice things.”

You may think that money is directly tied to your self-worth and your wealth shows your status. People with a money-status mindset tend to buy luxury items, high-end brands, or the latest products because they believe this spending increases their social standing and shows their wealth.

- Associates self-worth with net worth.

- Potential for gambling and lying about finances.

- May lead to overspending.

Money worship

“I can never have enough.”

Your belief tells you that money can solve all your problems and wealth is the key to happiness. Money worshippers may focus on their wealth at the expense of personal relationships or well-being. You may work excessively to damage your family and health to become financially wealthy.

- Equating money with happiness.

- Excessive spending for fulfilment.

- Workaholic tendencies.

Money avoidance

“I don’t deserve it.”

You may think that all wealthy people are greedy or that money is the root of all evil. Most people lead themselves to obtain money, while a money-avoidance mindset drives them to run away from money. You may avoid dealing with your finances, feel guilty about spending, or feel uncomfortable negotiating your salary.

- Believe that money leads to corruption.

- Feeling unworthy or guilty about money.

Money vigilance

“Let’s not talk about it.”

You are cautious and silent about your finances. Saving for the future or staying away from debts may be the most common actions in your life. Everyone wants to save more money or retire early (F.I.R.E.), but it is not healthy to give up your daily healthy life to do so.

- Emphasizing saving.

- Viewing handouts negatively.

- Avoiding debt and experiencing anxiety about finances.

It is possible to break that cycle

We understand that the roots of our financial behaviours come from our childhood, but it is essential to remember that it is also possible to reshape these patterns. Here are some tips to break free from negative financial cycles and change your behaviours to empower yourself.

- Awareness and acknowledgement: Starting is half done, so acknowledgement is your starting point. This self-awareness allows you to understand the reasons for your financial decisions and how your past influences your today.

- Education and adaptation: Increasing financial literacy is essential to learning new financial habits to replace your behaviours. This knowledge may come from books, seminars, online courses, blogs, etc.

- Professional guidance: If you need extra support, consult financial advisors to align your financial practices with your goals. They also help you to understand the emotional and psychological factors behind your behaviours.

Tips for creating a healthy financial attitude

You can break the cycle for yourself, but what about your child? Here are some tips for you as a parent to help create a healthy financial mindset for your children:

- Be mindful of your spending habits, e.g. saving regularly and making informed decisions.

- Allow your children to earn, save, and spend money with age-appropriate chores and allowances, increasing their financial experience.

- Encourage savings by setting goals, creating plans, and tracking the progress.

- Discuss financial and family purchasing decisions with your children to increase their involvement and awareness.

- Use real-life examples and activities to teach financial literacy with basic concepts such as budgeting, interest, credit, etc.

- Promote generosity by introducing volunteering and charity to your children to develop financial gratitude and responsibility.

Rewriting our financial narratives

There is an undeniable connection between your childhood experiences and your current financial behaviours. The past shapes you, but it doesn’t have to define you. Awareness, knowledge, and sometimes external support may help you break the cycle and establish a direction for your goals that aligns with your values. There are endless possibilities for rewriting our financial history into a balanced, happy, and secure financial life.

Rest assured, it will not be easy, but there are numerous product futures in Wealt that can help you on this journey and keep you in check. After all, this is one of the reasons why we are building Wealt in the first place.

Our blog

Latest blog posts

Tool and strategies modern teams need to help their companies grow.